Home

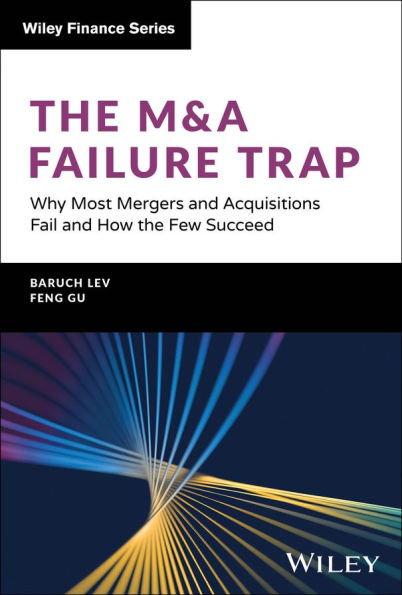

the M&A Failure Trap: Why Most Mergers and Acquisitions Fail How Few Succeed

Barnes and Noble

the M&A Failure Trap: Why Most Mergers and Acquisitions Fail How Few Succeed

Current price: $55.00

Barnes and Noble

the M&A Failure Trap: Why Most Mergers and Acquisitions Fail How Few Succeed

Current price: $55.00

Size: Hardcover

Loading Inventory...

*Product information may vary - to confirm product availability, pricing, shipping and return information please contact Barnes and Noble

An essential read about M&A for executives and investors who make critical decisions when M&A events and opportunities happen.

In

The M&A Failure Trap: Why Most Mergers and Acquisitions Fail and How the Few Succeed,

a distinguished team of finance and accounting researchers and practitioners delivers a practical and up-to-date exploration of the shortcomings of managerial mergers and acquisitions decisions. In the book, you'll discover:

Why 70-75% of all corporate acquisitions fail

How to substantially improve acquisition decisions

How to predict a specific merger outcome

All the lessons and advice provided in this book are fact-based—derived from a sample of 40,000 real-life merger cases around the world which are thoroughly analyzed and provide the foundations for our findings and recommendations.

The authors offer keen insights into the most important predictors of mergers and acquisitions failure and success and show you how to identify the potential warning signs of a problematic transaction. The book also provides insights into the human element of M&As: what happens to executives and employees of failed acquisitions. You will also find in the book a comprehensive review of the state-of-the-art research on M&As and numerous analyses of successful and unsuccessful real-life mergers.

Perfect for executives and directors contemplating a major M&A decision or currently engaged in such a transaction,

The M&A Failure Trap

will also earn a place in the libraries of students of business and economics, as well as investors faced with decisions impacted by a merger or acquisition, and shareholders expected to vote on an upcoming transaction.

In

The M&A Failure Trap: Why Most Mergers and Acquisitions Fail and How the Few Succeed,

a distinguished team of finance and accounting researchers and practitioners delivers a practical and up-to-date exploration of the shortcomings of managerial mergers and acquisitions decisions. In the book, you'll discover:

Why 70-75% of all corporate acquisitions fail

How to substantially improve acquisition decisions

How to predict a specific merger outcome

All the lessons and advice provided in this book are fact-based—derived from a sample of 40,000 real-life merger cases around the world which are thoroughly analyzed and provide the foundations for our findings and recommendations.

The authors offer keen insights into the most important predictors of mergers and acquisitions failure and success and show you how to identify the potential warning signs of a problematic transaction. The book also provides insights into the human element of M&As: what happens to executives and employees of failed acquisitions. You will also find in the book a comprehensive review of the state-of-the-art research on M&As and numerous analyses of successful and unsuccessful real-life mergers.

Perfect for executives and directors contemplating a major M&A decision or currently engaged in such a transaction,

The M&A Failure Trap

will also earn a place in the libraries of students of business and economics, as well as investors faced with decisions impacted by a merger or acquisition, and shareholders expected to vote on an upcoming transaction.